THE POCKET MONEY PINCH: INFLATION FUELS SURGE OF THE ‘SCHOOLKID SIDE HUSTLE’

ROOSTERMONEY POCKET MONEY INDEX REVEALS FLOURISHING ENTREPRENEURIAL STREAK AS UK CHILDREN FACE ALLOWANCE STAGFLATION

- UK’S MOST ESTABLISHED ANNUAL POCKET MONEY INDEX REVEALS KIDS’ AV. POCKET MONEY HAS STAYED FLAT YoY - THIS IS DESPITE INFLATION HITTING A 30-YEAR HIGH

- KIDS ARE TURNING TO SIDE HUSTLES AND GOOD GRADES IN RECORD NUMBERS TO TOP UP EARNINGS

- NOT ALL BAD NEWS - VOLATILE POCKET MONEY MARKET SEES KIDS RECEIVE MORE MONEY THAN EVER AROUND CHRISTMAS 2021

- ROOSTERMONEY’S RESEARCH OF 65,000 KIDS REVEALS EARNING, SPENDING AND SAVING HABITS FOR 4-14 YEAR OLDS IN THE UK

UK CHILDREN are facing pocket money stagflation, according to the latest study by kids money management specialist, RoosterMoney.

The average amount of pocket money children got in 2021 was £6.14, down fourpence from 2020 levels (£6.18). Next to a 5.5% inflation rate, it seems like kids aren’t exempt from the same macroeconomic pressures their parents face.

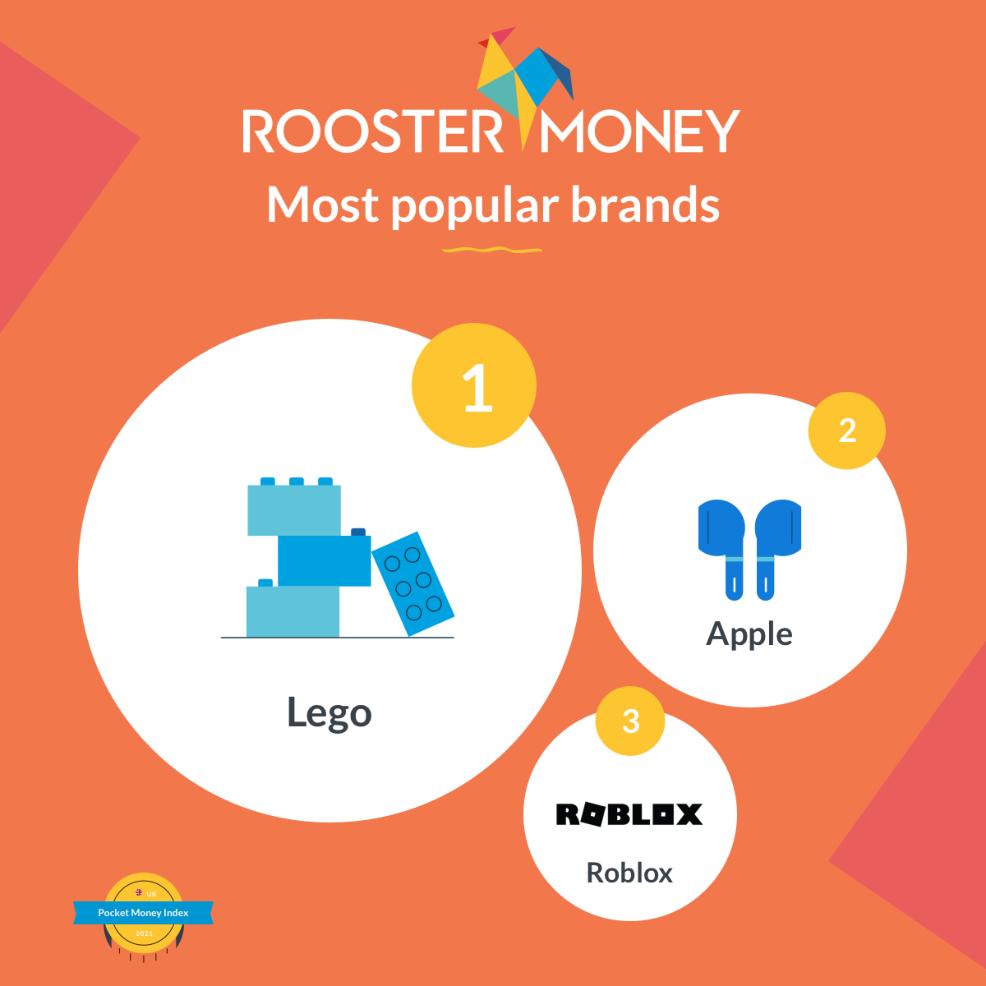

Indeed, the ‘cost of being a kid’ is higher than ever, with desk research from RoosterMoney uncovering soaring prices for the items kids most love to spend their money on. LEGO (which is second on RoosterMoney’s ‘Most Saved For’ list) was at the receiving end of a petition regarding its price increases recently, whilst the cost of gaming has increased in the face of new, next-gen consoles such as the PlayStation 5 and accompanying higher-priced games.

What’s more, according to Kantar, crisps and soft drinks - some of kids’ favourite treats - have experienced some of their biggest price rises in years, and - in response to the pandemic - some leading cinema chains have hiked their ticket prices by as much as 40%.

Wage deflation is fuelling the surge of the side hustle

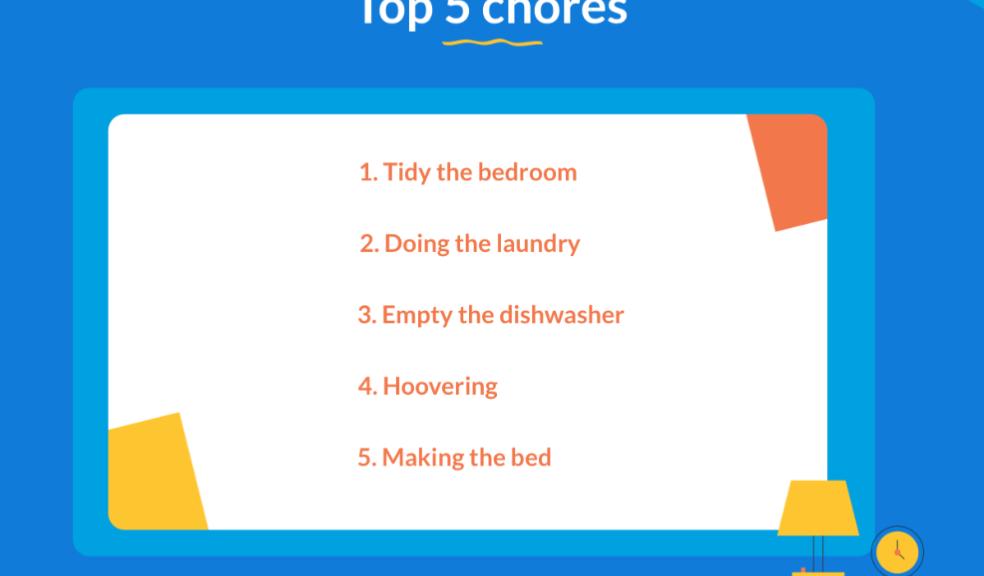

Whilst kids’ pocket money has stayed flat year on year, where the money comes from is changing, with go-to chores now earning them less.

Faced with a decrease in pay of 4.7% across the top five lucrative household chores (washing the car, mowing the lawn, raking leaves, cleaning windows and gardening), helping around the house has proved less significant on kids' pocket money levels.

To make up for this wage deflation, children have increasingly turned to ‘side hustles’, with sales of old possessions on platforms such as Depop growing by 67% between 2020 and 2021. Performing well at school was another high earner, after payouts for a good school report rose by 75% (from £8.15 in 2020 to £14.94 in 2021).

Aunts and uncles outstrip doting grandparents in gifting stakes

Special occasion ‘boosts’ also helped children navigate wage deflation and cost of living increases - children received £41.94 on average in birthday money, compared to £34.81 in 2020.

Interestingly, aunts and uncles have overtaken grandparents as the most generous gifters - averaging £19.90 in special occasion handouts compared to grandparents (£15.22). This is a reverse of 2020, when grandparents gave out an average of £18.99 compared to aunts/uncles dishing out £17.75.

Despite the difficult economic climate, kids managed to save 39% of their pocket money last year, up 2% on 2020 levels.

There was little change in how many parents gave their kids regular allowances in 2021 (66% in 2020 versus 65% in 2021), and Saturday remained the favourite for payday, accounting for 62% of children (versus 63% in 2020). Both Wednesdays and Thursdays were near write-offs for pocket money, with only 2% of children coming into a midweek pick-me-up.

Will Carmichael, RoosterMoney CEO says:

“Our 2022 Pocket Money Index is revealing in a number of ways. Despite facing stagflation - caused in no small part by wage deflation for household chores - it’s clear that kids are as resourceful as ever, having turned to re-selling their items to top up their RoosterMoney cards, and saving more than ever.

“We’ve seen some shifts in spending habits, too, with phones overtaking LEGO as the most saved-for item.

“Now, more than ever, instilling financial capability in our kids is so incredibly important. The financial impact of the pandemic has the potential to affect us for a generation - perhaps several.

“Having confidence with money, building positive habits around saving and learning to make considered spending choices are essential skills that will stick with kids for life.”

RoosterMoney was acquired by NatWest in 2021 as part of the bank’s strategy to help families and young people manage their finances more easily.

Other Parenting Articles for you

To read 'Five most common pocket money chores revealed' click here

To read '10 expert lessons to teach your children about money' click here