ENERGY DEBT GAP WIDENS: HOUSEHOLDS IN CREDIT SEE BALANCES DOUBLE WHILE THOSE IN DEBT OWE MORE

- The UK’s energy divide is growing, with household energy debt rising by a fifth to £190 while those in credit see average balances double since last autumn[1]

- Nearly three million households owe money to their energy providers, and another eight million have no credit at all[1]

- Those in credit have managed to build up a war chest as two thirds of households (64%) have an average £249 in credit with their supplier[1] – almost double what it was last autumn[2]

- Four in five households (80%) are worried about the current Energy Price Guarantee ending in April, and nine in ten (91%) want clarity on what happens next[3]

- With energy inequality rising, Uswitch.com is calling on the Government to ensure that vulnerable customers are considered the highest priority for additional support beyond April 2023.

An energy divide is growing across the UK, with average household energy debt rising by a fifth (19%) to £190 in the last year – as those in credit see their balances nearly double to £249, according to new research from Uswitch.com, the comparison service.

Nearly three million households owe an average of £190 to their providers[1] – a 19% increase from £159 last autumn[2]. Two fifths of those in debt (42%) say their arrears are higher than last autumn, and one in five households say they have moved from credit into debt over the course of the year[4].

At the same time, those in credit are building up bigger war chests than ever. Two thirds (64%) of households have built up credit ahead of winter, with the average credit of £249[1] almost double what it was last autumn. A fifth of those in credit (19%) say they have more credit than this time last year.

Suppliers have increased household direct debits in reaction to changes in rates from the energy price cap and Energy Price Guarantee, which may explain increased levels of energy credit for those who have been able to afford it.

Equally, the mild autumn will have resulted in people using less energy in September and October, potentially allowing their credit to increase over those months.

This year eight million bill-payers have no credit balances at all[1], meaning they have no protection from high bills this winter.

Previous research found that two fifths of households (43%) were planning to turn down their thermostat this year, while a third (32%) said they would wait to turn their heating on later than normal[5].

Households are predicted to pay on average £232 more for energy over the three coldest months than they did last year, despite the Government’s Energy Price Guarantee and £400 energy bill support[6].

However, the expected changes to the price guarantee in April are already causing concern. The price cap could reach around £3,702 in April — a 48% rise from the current £2,500 price guarantee, according to the latest prediction from Cornwall Insight[7].

Four in five households (80%) are worried about the Energy Price Guarantee ending in April, and nine in ten (91%) want clarity on what happens next[3]. Nearly half (47%) of households say they won’t be able to manage their bills unless there is additional support once the scheme ends[3].

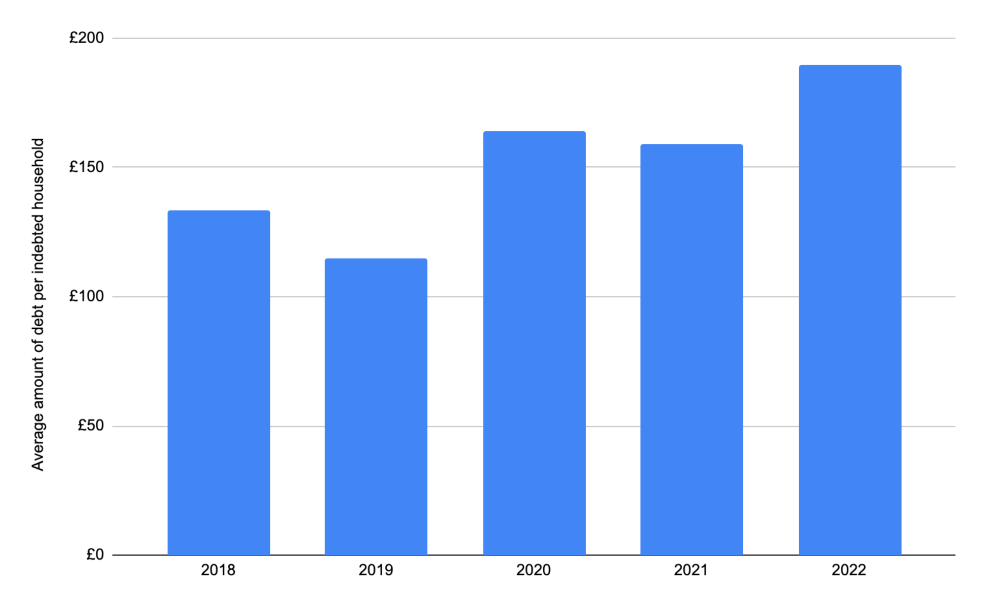

Graph: Average household debt in autumn since October 2018

Table: Average household debt in autumn since October 2018

| Date | Proportion of households in energy debt | Average amount of debt per indebted household |

| 2018 | 11% | £134 |

| 2019 | 8% | £115 |

| 2020 | 10% | £164 |

| 2021 | 12% | £159 |

| 2022 | 10% | £190 |

Source: Uswitch.com

Uswitch.com is calling on the Government to ensure that vulnerable customers are considered the highest priority for additional support beyond April 2023.

Richard Neudegg, director of regulation at Uswitch.com, comments: “A gulf is growing between the UK’s energy haves and have-nots, with energy credit soaring for some as debt swells for others.

“Building up a war chest of energy credit is always important as we head into winter, and it is good news that two thirds of households have managed to build up a buffer. For those lucky households accumulating credit, the £66 a month energy bill support will have been an extra leg up.

“Even though credit is increasing for some households, average household energy debt for autumn is still at the highest level we’ve seen in more than three years, and if bills rise again in April, this will create a perilous situation for many people.

“With the Energy Price Guarantee ending in April, it is critical that the Government urgently provides more clarity on how it will help vulnerable households with rising energy bills in 2023.

“If your energy account is going into debt or you are behind on your bill payments, speak to your provider as soon as possible. They should be able to help you find a solution, such as working out a more affordable payment plan. You may also find you are eligible for additional support such as hardship funds and other energy help schemes.”

Find out how to save on your household bills here.

Cover photo from Canva