8 ways to make private education more affordable

Cost of private education rises 5.6% with average parents increasingly priced out:

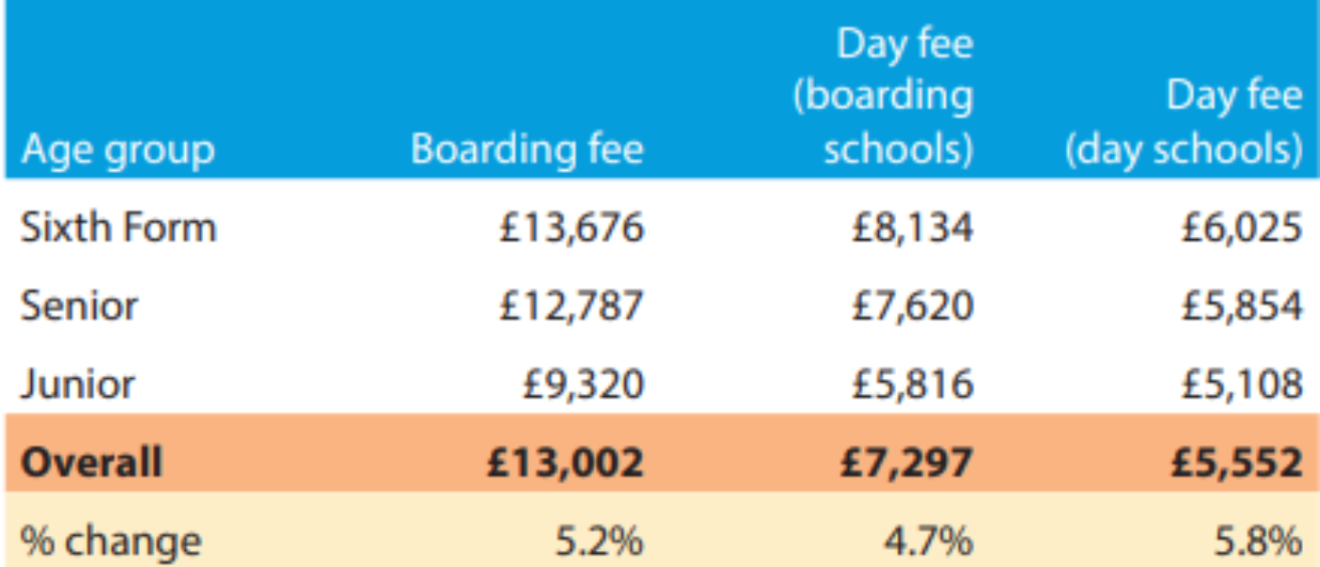

· Typical annual boarding school fee for a secondary school pupil rises 5.2% to hit £39,006 while the average annual day school fee up 5.8% to £16,656

· With further fee hikes expected, parents set on a private education must either be ultra-wealthy, have a sound financial plan or have generous relatives

A private school education is at risk of becoming a luxury only afforded by the ultra-wealthy with average fees rising 5.6% across all independent schools, whether primary, secondary, day or boarding, in the 12 months to January 2023, according to the latest census from the Independent Schools Council published today.

The average day school fee rose 5.8% to £5,552 per term or £16,656, with the biggest outlay for sixth form students with termly fees of £6,025 and an annual cost of £18,075. The average boarding school fee jumped 5.2% to £13,002 per term or £39,006, while a sixth form boarder would set parents back £13,676 per term on average or £41,028.

Alice Haine, Personal Finance Analyst at Bestinvest, the DIY investment platform and coaching service, comments:

“The worry, however, is that fees are expected to jump more dramatically in the next academic year as school heads grapple with mounting cost pressures. Add in the prospect of a future Labour Government honouring its pledge to add 20% VAT to school fees and many parents may be forced to abandon plans to privately educate their offspring, opting for a taxpayer-funded state education instead.

“The worry, however, is that fees are expected to jump more dramatically in the next academic year as school heads grapple with mounting cost pressures. Add in the prospect of a future Labour Government honouring its pledge to add 20% VAT to school fees and many parents may be forced to abandon plans to privately educate their offspring, opting for a taxpayer-funded state education instead.

“For those with children already in the private system, the threat of further fee hikes when they are already juggling higher household bills and a much heavier tax regime may force them to take the difficult and unwelcome step of pulling their offspring from school mid-way through their education. This would see private education become a luxury only afforded by the super-rich, rather than the domain of aspirational professionals, such as doctors and lawyers, willing to make sacrifices elsewhere to give their children the best possible start in life.”

The ISC’s 2023 Census reflects a very different landscape to the 2021 report when two-thirds of the schools either froze or reduced their fees to compensate parents during the Covid-19 pandemic for children attending school from home – leading to an average annual fee increase of just 1.1% - the lowest rise since 1971. Even the 2022 census saw a below-inflation increase of 3.1% as schools and parents adjusted to the post-pandemic era.

Haine adds: “This year, the cost-of-living crisis is posing a big challenge for schools and household budgets alike. For parents already scrimping to meet bills, most of which won’t have received inflation-linked pay rises themselves and who are also contending with bigger tax bills thanks to the raft of frozen or reduced personal allowances, they face stark choices. Either they take the fee hikes on the chin and dip into savings or pull children out of their schools and put them into the state system instead. Others may choose a private education for a shorter period, such as for secondary education or the sixth form, while those completely priced out by fee hikes may bypass the option altogether.”

Despite high fees, pupil numbers at independent schools covered by the ISC rose to 554, 243, up from 544, 316 in 2022, with every UK region reporting an increase in private school pupils, and state school pupils comprising the largest group of new entrants.

While a private education may seem unachievable for some, those with a cast-iron financial plan in place or the lucky few with generous grandparents willing to contribute or shoulder the costs in full may still be able to access the independent sector.

Here, Haine outlines how to make private school education more affordable:

1: Decide what age you want your child to start

With the average annual term fee ranging from £5,108 to £13,676 per term depending on which stage of the education your child is at and whether they are a day pupil or boarder, a private school education is no longer something parents can consider on the fly.

Even those considering the private sector for just a short portion of their child’s education – such as the primary years, secondary or sixth form - will also face a hefty bill. A sixth-form boarding place will cost £82,056 for the full two years, so that needs careful consideration.

Bearing in mind the fees for most prestigious public schools will be even higher, a typical family with two children at a top boarding private school would pay upwards of £80,000 per year or at least £560,00 for a seven-year stint. That would wipe out the take-home pay of around £76,600 of an additional rate taxpayer earning £125,140, making private schooling an incredible challenge if funded on a pay-as-you-go basis out of taxed income, even for higher earners.

School Fees

Before you calculate your budget, decide what stage of education private schooling will deliver the most value. For some parents, giving their child the best possible start early on with a private primary education might be a priority. For others, entry at age 11 or 13 to expose their child to a private system in their secondary years to tie in with key exams – something the Census reflects with the largest increase in private school numbers falling in the GCSE years - might be preferable as it also gives them longer to save.

Alternatively, paying for the sixth form years may be attractive for parents who want their children to learn to be more independent as a boarder or have access to smaller class sizes. Conversely, many parents who have already shelled out for a private education may choose the sixth form to send their child to a state college, either for financial reasons, to improve chances of Oxbridge entry where there is pressure to improve state school intake, or perhaps because their child has shown an aptitude for certain subjects not offered by the existing school.

2. Financial planning is key, so calculate your budget to set your savings goal

If sending your children to private school is a major life goal and you don’t have excess savings or access to family money, then planning ahead and building up a sizeable savings pot is the only option. The last thing any parent wants is to run out of money midway through a child’s schooling and be forced to pull them out suddenly, disrupting their learning and friendships in the process.

To calculate your budget, multiply the number of years you want to pay for by the number of children you have and make some assumptions on inflation, as well as the potential addition of VAT. Your calculation should also factor in the additional expenses that come with private education, such as uniforms, sports kits, books, trips abroad, music lessons, learning support and more.

Those with tighter budgets can choose a lower-priced school with fewer frills that still offers the perk of smaller class sizes to make your goal more realistic. Alternatively, lessen the number of years your child is in the private school system to reduce the financial hit.

For some families, sending their children to private school means making financial sacrifices elsewhere, whether it’s downsizing to a smaller home, holidaying in the UK rather than overseas, rarely going out for meals or entertainment and sticking with the same cars for several years – so be realistic about the financial consequences of taking on such a large expense.

3. Remember, fees are only going to go up again so adjust your budget accordingly

Average fees may have risen 5.6% this academic year, but parents are already bracing themselves for another hit in the 2023-24 academic year when many schools are expected to increase their fees by up to 10% or more to cover rising costs.

Add in Labour’s proposal to add 20% VAT to school fees and middle-income parents, who are also contending with sky-high inflation, with the cost-of-living crisis constraining expenditure for parents, may find themselves struggling. It is vital for anyone considering entering their children into private education over the next few years, to factor in this possibility in their funding plans given Labour’s strong lead in the polls.

But private schools are not immune to the economic pressures felt in the wider economy either. Higher energy bills, rising wage and pensions costs for teachers as well as high maintenance and catering costs leave school heads with tough choices to make – particularly as some private schools have faced industrial action from frustrated staff. Either they increase fees – a move that risks alienating parents - or cut costs by reducing scholarships and bursaries, removing minority subjects, or slashing staff fee discounts. Many private schools are also mulling an exit from the Teachers’ Pension Scheme following the government’s 2019 decision to raise the rate of employer contributions by 43%. While state schools are covered for the hike, private schools are not, with some schools withdrawing from the scheme altogether or offering staff a choice between the TPS and a private scheme.

4. Save and invest towards it in a tax-efficient way

Once you have a plan, you can then determine how much money needs to be stashed away and later generated each year and match any investment strategy to the goal you need to hit to pay school fees for the entire duration of your child’s education.

Even with saving rates jumping up in recent months, sticking money into a regular bank savings account is not going to pay for a private school education. High inflation will erode any gains and there’s no guarantee savings rates will stay this high over the long term.

A long-term, diversified investment strategy has the potential to deliver a healthier return as your money works harder for you. Higher-risk investments such as equity funds can be used to fund costs that are many years away, with cash and less volatile assets used for the earlier years of private education.

Making your investments as tax efficient as possible is also a wise move as money held in a regular savings account can be at risk of peaching the Personal Savings Allowance (£1,000 for basic rate taxpayers, £500 for higher rate taxpayers and zero for additional rate taxpayers) because of the higher interest rate environment.

Taking advantage of your £20,000 ISA allowance can be a wise storage strategy for your school pot as all income and capital gains are tax-free. allowing parents to grow the fund and withdraw investments when they want without fear of a hefty tax bill at the end.

5. Don't attempt a ‘pay-as-you-go approach’ - it’s far too risky

Paying school fees on the go is a high-risk strategy even for families with very high incomes. Unexpected life events, such as job loss or large, unplanned costs that eat into your monthly expenditure, can derail plans to pay school fees on time. Plus paying school fee costs out of taxed income puts finances under tremendous strain, particularly for those with more than one child, when you consider all the other living expenses that need to be met.

This is why parents who do want to go down the private education route must lock in that goal as early as possible to ensure they have a viable financial plan in place to meet these costs. This prevents the financial stress that will inevitably come in tight financial times as no one wants to be worrying about how the next school fee bill will be paid.

6. Tap the bank of Grandma and Granddad but don’t forget about IHT

If a private education is out of your financial reach, but perfectly manageable for the child’s grandparents, it might be time for a frank conversation. Wealthy grandparents are often happy to contribute or fund the full cost, particularly if their generosity also reduces a future inheritance tax liability.

Remember, however, school fee contributions will be treated as a gift to their grandchild for tax purposes, even if they are made directly to the grandchild’s school. While gifts made to individuals are not instantly liable for inheritance tax, if the grandparent dies within seven years, then there may be a retrospective liability.

One option often used in circumstances where a grandparent makes a substantial gift to finance school fees is establishing a trust on behalf of the child. The gift into the trust is a potentially exempt transfer for inheritance tax purposes after seven years. In this situation, the trustees retain full control over where the assets are invested and drawn down upon but as the child is the ultimate owner of trust assets, they will be taxed against the child’s income tax and capital gains tax allowances/exemptions, making this very tax efficient.

Other exceptions grandparents can tap into include the annual gift exemption of £3,000 per year that can be given away free of IHT. This can be carried forward by one year if it was previously unused. So, two grandparents using their exemption for the first time could contribute £6,000 each or £12,000 in the first year, and £6,000 for each subsequent year.

Another useful exemption applies to regular gifts out of surplus income. As long as their income does not exceed their outgoings or impact their lifestyle, then regular gifts can be made without an IHT liability. Remember to keep a record of all the gifts made and the calculations that prove this is from surplus income just in case HMRC wants further evidence that the payments fall within their rules.

Generous grandparents should also be sensible when it comes to gifting. There’s no point funding their grandchild’s education if they are putting their own financial stability at risk so do the sums carefully or seek financial advice if you are unsure. The tax implications of giving financial gifts are complicated, so grandparents must read up on the rules first or consult a qualified tax planner who can advise them of the best course of action.

7. Consider scholarships, bursaries, and paying upfront to cut costs

Most private schools offer scholarships or bursaries for children who are either very gifted in a particular subject, such as in maths or science, or a skill, such as music, drama or sport, or can demonstrate a financial need to receive support. While a scholarship can wipe a fixed percentage off the annual fee bill, such as 10%, bursaries can offer bigger reductions, sometimes covering the fees in full along with uniforms and other costs – though this is at the discretion of the school.

More than 30% of pupils receive some form of fee assistance, with fee assistance breaking the billion-pound barrier for the first time in the year to January 2023 with the average value of a bursary hitting £11,800. There is also a trend towards more high-value bursaries, with an increasing number of pupils receiving bursaries worth 75% or more of fees.

While most fee assistance comes directly from the schools and is means-tested. some charitable trusts can also help parents in the private school system in cases of genuine need though their criteria for who receives the money is often dependent on social need such as the sudden death of the family breadwinner or parents who get into financial difficulty.

Schools may also offer discounts on fees paid in advance or offer sibling discounts for families with more than one child at the same school while certain professions can secure a hefty discount, such as qualifying officers in the Armed Forces and the clergy. Teachers working in private schools may also secure discounts on fees from a set reduction, such as 50%, to fees being covered in full.

8. For the biggest saving, skip a private school education altogether

While many families may aspire to give their children an independent education, hopeful that smaller class sizes, an extensive range of extracurricular activities along with personal support and pastoral care and top-class facilities will accelerate their child’s learning, the reality is that they may even be at a disadvantage.

Firstly, some private schools offer a limited range of subject options for GCSE and A Levels compared to their state counterparts. Secondly, private schools don’t always attain the top grades for those seeking a high academic standard, often because of their extensive extracurricular programmes that take up a large part of a student’s time. A private school day can be long, so parents that want to see more of their children may feel they are missing time with them.

Attending a private school education can also be a disadvantage for those that want to access an elite UK university, such as Oxford and Cambridge, who are under pressure to increase their intake of state school pupils. Recent studies have found private schools are now less likely to be offered a place to study at an elite institution than their state school counterparts, with private schools finding the numbers of their pupils successfully gaining places at top universities declining significantly in recent years. Some privately educated children with stellar academic records are now choosing to switch to a state college for their sixth-form years to help secure a place at the university of their dreams.

Many middle-class parents who might have once considered private schools in the past are now sending kids to state schools but topping up with private tutoring outside of school hours. This has become much more accessible through online tutoring services, often using undergraduates. As well as being more affordable, it will not appear on children’s university applications at a time when leading universities are being accused of bias against the private sector. In this part of the market, “private” education is alive and well.