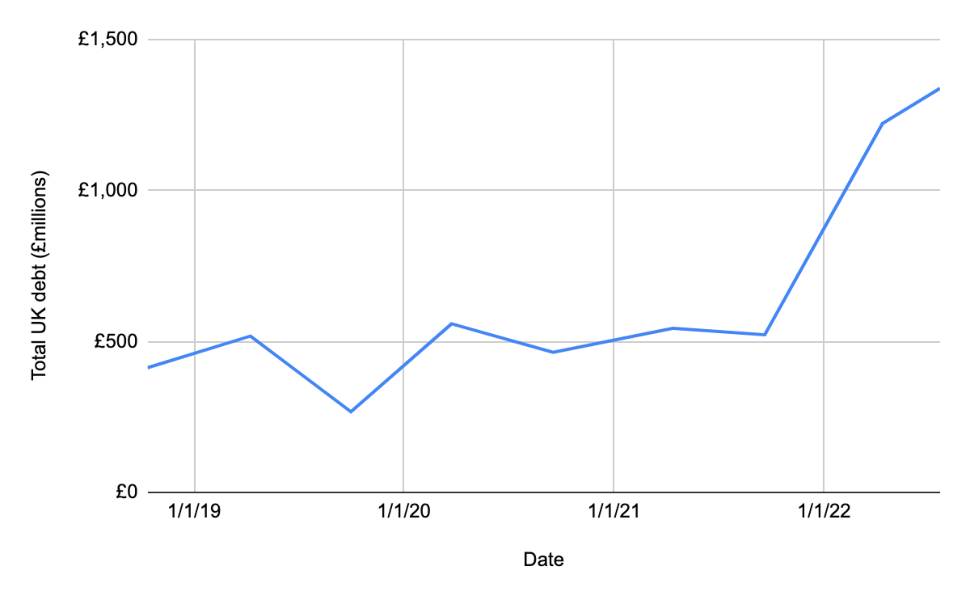

HOUSEHOLDS ALREADY OWE £1.3 BILLION TO ENERGY SUPPLIERS AHEAD OF WINTER BILLS TIMEBOMB

- Energy debt is at an all-time high with £1.3 billion owed to providers[1] – more than 250% higher than it was in September last year[2]

- Six million households owe an average £206 to providers[1], 10% more than they owed in April and at a time of year when they should usually have built up credit to cope with winter bills

- The number of homes in credit has dropped from 11 million to nine million since April

- Eight million households have no credit balances at all[3], leaving them with no protection from hardship in the coming months

- Uswitch is urging households who can’t keep up with energy bills to contact their suppliers and request a more affordable payment plan.

Ahead of the autumn bill hikes, household energy debt is standing at an all-time high of £1.3 billion[1] – nearly three times higher than it was in September last year[2], according to new research from Uswitch.com, the comparison and switching service.

Six million homes – almost a quarter of households (23%) – owe an average of £206 to their energy provider this summer[1], a 10% increase in just four months from April, where the average debt was £188. This would traditionally be a time of year when bill-payers would expect to have built up a war chest to cope with winter bills.

On 26th August Ofgem will announce the new level of the price cap, which is predicted to rise from £1,971 to £3,358[5] and result in energy bills rocketing this winter.

Another eight million bill-payers have no credit balances, meaning 14 million households have no protection from hardship this winter[3].

Graph: UK energy debt since October 2018

Almost a fifth of bill-payers (18%) are worried about their supplier forcing them onto a prepayment meter this winter due to their debt. Nearly two in five (38%) consumers didn’t know this was something their provider could do[6].

Justina Miltienyte, head of policy at Uswitch.com, said: “Energy debt has hit an all-time high with the worst possible timing, turning this winter’s energy price hike into a deeply precarious situation for many households.

“Our data shows that while a similar proportion of people are in debt as in April - people now owe approximately 10% more than just four months ago to their energy suppliers. This is an alarming situation, as summer is traditionally a time when households are using less power for heating, which helps bill payers to build up energy credit ahead of the winter.

“This also suggests the cost-of-living crisis is already squeezing budgets dramatically, even during the summer months, as families struggle with rising bills in all areas.

“If you are behind on your bill payments, or your energy account is going into debt, speak to your provider as soon as possible. They should be able to help you find a solution, such as working out a more affordable payment plan. You may also find you are eligible for additional support such as hardship funds and other energy help schemes.”

“The Government also needs to take energy debt seriously ahead of the winter - and a greater support package for vulnerable households needs to be agreed as a priority”.

Find out if you’re eligible for an energy help scheme, grant or benefit here