Children's piggy banks hit as parents adapt to cost of living pressures

-

Average weekly pocket money is down 23 per cent year-on-year from £6.48 to £4.99, new research reveals

-

Mums and dads are feeling the pinch most from increasing energy and food bills; half would rather sacrifice spending on their own leisure activities to protect pocket money

-

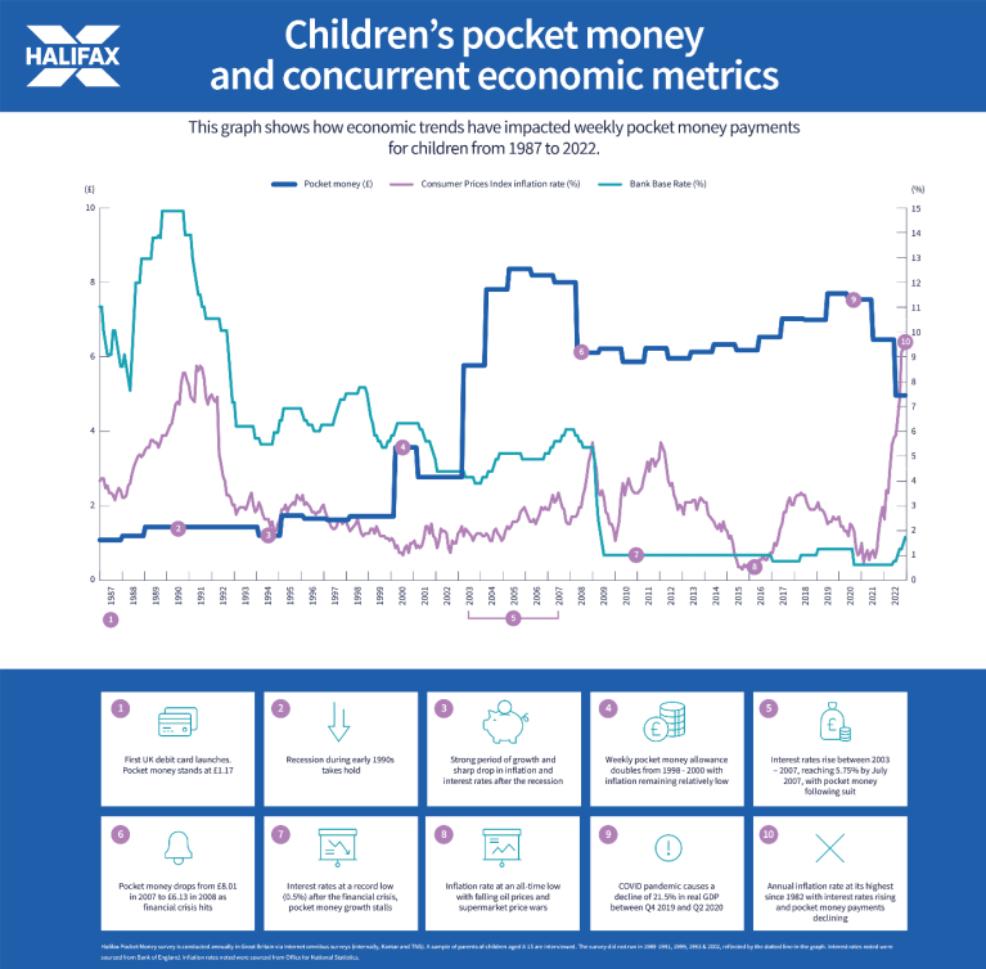

Halifax reveals the economic impact on pocket money over last 35 years

Parents are feeling the pinch and it’s trickling down to their children - Halifax’s annual Pocket Money survey reveals that, as they adapt to cost of living pressures, nearly a third of parents (32%) have altered how much they’re putting into their children’s piggy banks each week, down to £4.99 this year from £6.48 in 2021 - confirming that kids are also feeling the effects of the increasing cost-of-living.

However, it’s not all bad news for UK youngsters with the research also uncovering that, although parents have cut back on pocket money, they’re prepared to make changes to their lifestyles to keep their kids’ cash flowing.

Half (50%) of British parents say they’d sacrifice spending on their own leisure, such as hitting the pub or eating out; or give up treating themselves to personal items including make-up and designer goods (45%) to make sure that they’re still topping up their children’s funds. 41% also said they’d stop spending on their own hobbies or spend less on the weekly supermarket shop (25%).

Despite this, over a third of parents (32%) are expecting their children to do more around the house to earn their pocket money this year.

Emma Abrahams, Head of Savings, Halifax, said: “As household costs continue to rise, some parents are having to make difficult choices as they adapt to the conditions they face - from cutting down the family grocery bill, to passing on date night, or that much-wanted personal purchase at the shops. Our research reveals that parents are, in fact, protecting their kids’ cash during this time, with many sacrificing spending on themselves rather than cut back on pocket money.”

Top pocket money purchases

Although there’s less to spend on goodies this year, parents have revealed what their children are spending their pocket money on, with gaming and sweets coming out on top (39% each), followed by toys (30%), clothing (29%), and hobbies, i.e., books (28%). Interestingly, only a fifth of parents (22%) say their children are most likely to save their pocket money, proving that there’s room for open conversations with kids around the importance of saving.

Chris Payne, father of triplets (four-year-old girls) and eldest son (six years-old), is feeling the pinch and the effect it has had on how his family: “As a parent of four and working fulltime in the emergency services sector, financial planning is important to us – and part of this is how much pocket money we give to our kids. Like others, we are experiencing the brunt of rising costs, and this means tweaking our lifestyles to accommodate new ways of living – but we haven’t compromised our approach to giving pocket money.

“Working hard for earnings is no stranger to my wife and I and we want to pass these values down to our kids. As my eldest son grows older, he is becoming more aware of financial responsibility. We’re constantly finding new ways to keep our kids motivated to help around the house and understand the value of money – he’s particularly excited to spend his earnings on Pokemon cards at the moment, however, loves to save as well.”

Economic impacts on parents’ purse strings

Energy bills appear to be the top crunch for British parents, with Halifax’s research revealing that 71% of parents surveyed are most worried about these payments; and 55% with rising food and grocery costs. Over half (58%) of parents also say that they’ve had to cut back on their savings because of the increasing cost of living.

Halifax has analysed the economic climate over the last 35 years versus weekly pocket money allowances to determine how it impacts what parents give to their children.

When set against the respective Bank Base Rate and inflation rates at the same time, it is clear that external factors have long had an impact on the amount of pocket money parents give their children.

Back in 1987 when Halifax undertook its first pocket money survey, children received an average of £1.17. weekly pocket money remained relatively stable throughout the 90’s until it doubled between 1998 and 2000.

As Interest rates increased between 2003 – 2007, reaching 5.75% by July 2007, weekly pocket money followed suit. However, alongside the 2007/2008 financial crisis, pocket money dropped from £8.01 in 2007 to £6.13 in 2008. More recently and leading up to the current increased cost of living, a sharp decline in weekly pocket money also correlated with the COVID pandemic.

Emma Abrahams continues: “We know finances can cause concern for households. Pocket money is a luxury that only some parents are able to offer their children and, for many, it’s not a feasible option. Having an open and honest conversation with your children about what you can afford to give is likely to improve their understanding and relationship with finances in the future.”

Halifax has a range of practical tips on budgeting, spending, and saving.